|

City of Lansing Retirement Systems

Updated January 1, 2023 |

Home

Directory |

Overview

The

City has two separate retirement systems, the Police and Fire

Retirement System (P&F) and the Employees Retirement System (ERS).

Membership in the Police and Fire Retirement System is

restricted to Fire Department

employees who hold the rank of

firefighter or higher and Police Department employees who hold the rank of patrolman or higher.

The

Employees Retirement System includes these groups: Teamsters,

Exempt, District Court, Executive Pay Plan, and UAW. Elected officials are excluded - they have only a

defined contribution plan.

Benefit

provisions are spelled out in the City ordinances, but those

provisions often change when new union contracts are negotiated and

months may pass before the ordinances get updated. Actuarial

valuations always include a section called "Summary of Plan

Benefits," and that section in the latest actuarial valuation may

contain the clearest and most up-to-date description of benefits

available. Links to the actuarial valuations are below.

Unlike other

City retirees, retired police and firefighters don't pay state taxes

on their pensions (starting with tax year 2013). Senate Bill 409 (analysis),

passed in December 2012, exempts pubic pensions from the state

income tax if the employing agency does not participate in the

social security system. Lansing's police and firefighters do not

contribute to or receive benefits from the social security system.

The two systems are governed by boards: the

Police and Fire Retirement System board and the Employees Retirement

System board. The Police and

Fire Retirement System board consists of

eight trustees: the mayor; a member of the city council selected by the

council; the city treasurer; a resident of the city, appointed by

the mayor; two members of the Police Department, elected by the

members of the Police Department; and two members of the Fire

Department, elected by the members of the Fire Department.

The

Employees Retirement System board consists of nine trustees: the

mayor; a member of the city

council selected by the council; the city treasurer; the human

resources director; three members of the retirement system elected

by the members of the system, not more than one from the same

department; and two Michigan residents, appointed by the mayor, one

a retiree of the system and the other not a member of the system.

The

Retirement Office website

provides names of retirement board members, meeting schedules,

budgets and financial

reports.

Retirements since

2010

Police and Fire Retirement System:

Police

Fire

Employees

Retirement System

Board meeting

minutes

Police

and Fire Retirement System

Employees

Retirement System

Joint Meetings

Actuarial valuations

Actuarial valuation reports

for pensions are issued at the end of the year and are based on information from

the previous year. They are published on the

Retirement Office website.

Since retiree health care is not the responsibility of the

retirement boards, actuarial valuations for retiree health care are not on the Retirement Office website or

anywhere else on the City's website. They can only be obtained

through FOIA. Until 2021, they came out every 2 years rather than

annually.

Pensions:

| |

Police and Fire:

|

2009,

2010,

2011,

2012,

2013,

2014,

2015,

2016, 2017,

2018,

2019,

2020,

2021 |

| |

Employees Retirement System: |

2009,

2010,

2011,

2012,

2013,

2014,

2015,

2016, 2017,

2018,

2019,

2020,

2021 |

Retiree health care (OPEB):

Police and Fire:

2011,

2013,

2016,

2018,

2020,

2021

Employees Retirement System:

2011,

2013,

2016,

2018,

2020,

2021

Pension funding history

Pensions are funded from 3 sources:

earnings on investments, member contributions and payments from the

City. The amounts the City is required to pay are determined by the

actuarial valuations. Payments are made at the end of the year,

after the actuarial valuations come out.

The source of the following is a

section in the actuarial valuation called "Historical Funding

Progress."

|

Police & Fire Retirement

System (P&F) |

|

As of

December 31: |

Actuarial Value

of Assets |

Actuarial

Accrued Liability |

Percentage

Funded |

Unfunded Actuarial

Accrued Liability |

|

2001 |

280,518,000 |

249,204,000 |

112.6% |

(31,314,000) |

|

2002 |

280,686,000 |

259,282,000 |

108.3% |

(21,404,000) |

|

2003 |

277,947,000 |

267,786,000 |

103.8% |

(10,161,000) |

|

2004 |

275,807,000 |

279,873,000 |

98.6% |

4,066,000 |

|

2005 |

275,216,000 |

290,299,000 |

94.8% |

15,083,000 |

|

2006 |

278,839,000 |

308,193,000 |

90.5% |

29,354,000 |

|

2007 |

293,571,000 |

315,635,000 |

93.0% |

22,064,000 |

|

2008 |

287,394,000 |

326,673,000 |

88.0% |

39,279,000 |

|

2009 |

280,342,000 |

337,315,000 |

83.1% |

56,973,000 |

|

2010 |

276,377,041 |

359,293,016 |

76.9% |

82,915,975 |

|

2011 |

264,492,738 |

372,547,509 |

71.0% |

108,054,771 |

|

2012 |

257,898,061 |

373,083,911 |

69.1% |

115,185,850 |

|

2013 |

277,267,947 |

383,879,280 |

72.2% |

106,611,332 |

|

2014 |

288,785,965 |

395,089,321 |

73.1% |

106,303,356 |

|

2015 |

292,531,481 |

410,189,555 |

71.3% |

117,658,075 |

|

2016 |

294,311,956 |

424,264,103 |

69.4% |

129,952,147 |

|

2017 |

302,362,351 |

441,891,242 |

68.4% |

139,528,892 |

|

2018 |

296,163,457 |

457,988,405 |

64.7% |

161,824,949 |

|

2019 |

286,067,027 |

463,371,047 |

61.7% |

177,304,020 |

|

2020 |

313,770,079 |

488,579,829 |

64.2% |

174,809,750 |

|

2021 |

329,564,511 |

500,182,752 |

65.9% |

170,618,241 |

|

Employees Retirement System

(ERS) |

|

As of

December 31: |

Actuarial Value

of Assets |

Actuarial

Accrued Liability |

Percentage

Funded |

Unfunded Actuarial

Accrued Liability |

|

2001 |

191,311,000 |

213,648,000 |

89.5% |

22,337,000 |

|

2002 |

192,920,000 |

215,405,000 |

89.6% |

22,484,000 |

|

2003 |

199,329,000 |

221,088,000 |

90.2% |

21,759,000 |

|

2004 |

206,200,000 |

231,389,000 |

89.1% |

25,189,000 |

|

2005 |

207,881,000 |

241,882,000 |

85.9% |

34,001,000 |

|

2006 |

208,765,000 |

251,427,000 |

83.0% |

42,662,000 |

|

2007 |

208,572,000 |

254,356,000 |

82.0% |

45,784,000 |

|

2008 |

200,600,000 |

258,331,000 |

77.7% |

57,731,000 |

|

2009 |

193,324,000 |

262,298,000 |

73.7% |

68,974,000 |

|

2010 |

187,440,590 |

269,461,935 |

69.6% |

82,021,345 |

|

2011 |

177,100,863 |

287,306,707 |

61.6% |

110,205,844 |

|

2012 |

167,569,807 |

293,974,433 |

57.0% |

126,404,626 |

|

2013 |

172,687,582 |

313,258,746 |

55.1% |

140,571,164 |

|

2014 |

177,259,421 |

309,924,744 |

57.2% |

132,665,323 |

|

2015 |

176,031,902 |

308,794,993 |

57.0% |

132,763,091 |

|

2016 |

176,160,086 |

305,886,505 |

57.6% |

129,726,419 |

|

2017 |

178,646,143 |

305,030,296 |

58.6% |

126,384,153 |

|

2018 |

172,090,691 |

303,408,333 |

56.7% |

131,317,642 |

|

2019 |

160,693,641 |

310,674,588 |

51.7% |

149,980,947 |

|

2020 |

173,353,792 |

316,451,462 |

54.8% |

143,097,670 |

|

2021 |

177,428,286 |

312,083,091 |

56.9% |

134,654,805 |

|

P&F and ERS Combined |

|

As of

December 31: |

Actuarial Value

of Assets |

Actuarial

Accrued Liability |

Percentage

Funded |

Unfunded Actuarial

Accrued Liability |

|

2001 |

471,829,000 |

462,852,000 |

101.9% |

-8,977,000 |

|

2002 |

473,606,000 |

474,687,000 |

99.8% |

1,080,000 |

|

2003 |

477,276,000 |

488,874,000 |

97.6% |

11,598,000 |

|

2004 |

482,007,000 |

511,262,000 |

94.3% |

29,255,000 |

|

2005 |

483,097,000 |

532,181,000 |

90.8% |

49,084,000 |

|

2006 |

487,604,000 |

559,620,000 |

87.1% |

72,016,000 |

|

2007 |

502,143,000 |

569,991,000 |

88.1% |

67,848,000 |

|

2008 |

487,994,000 |

585,004,000 |

83.4% |

97,010,000 |

|

2009 |

473,666,000 |

599,613,000 |

79.0% |

125,947,000 |

|

2010 |

463,817,631 |

628,754,951 |

73.8% |

164,937,320 |

|

2011 |

441,593,601 |

659,854,216 |

66.9% |

218,260,615 |

|

2012 |

425,467,868 |

667,058,344 |

63.8% |

241,590,476 |

|

2013 |

449,955,529 |

697,138,026 |

64.5% |

247,182,496 |

|

2014 |

466,045,386 |

705,014,065 |

66.1% |

238,968,679 |

|

2015 |

468,563,383 |

718,984,548 |

65.2% |

250,421,166 |

|

2016 |

470,472,042 |

730,150,608 |

64.4% |

259,678,566 |

|

2017 |

481,008,494 |

746,921,538 |

64.4% |

265,913,045 |

|

2018 |

468,254,148 |

761,396,738 |

61.5% |

293,142,591 |

|

2019 |

446,760,668 |

774,045,635 |

57.7% |

327,284,967 |

|

2020 |

487,123,871 |

805,031,291 |

60.5% |

317,907,420 |

|

2021 |

506,992,797 |

812,245,843 |

62.4% |

305,273,046 |

City contributions to retirement

funds

The amount the City is required to

contribute to the retirement funds is determined in the actuarial

valuations. Payments are made around the end of the calendar year,

soon after the actuarial valuations come out. So, for example, the

required contribution for fiscal year 2022, which ends June 30,

2022, is determined in the 2021 actuarial report, which is based on

information supplied by the City at the end of 2020.

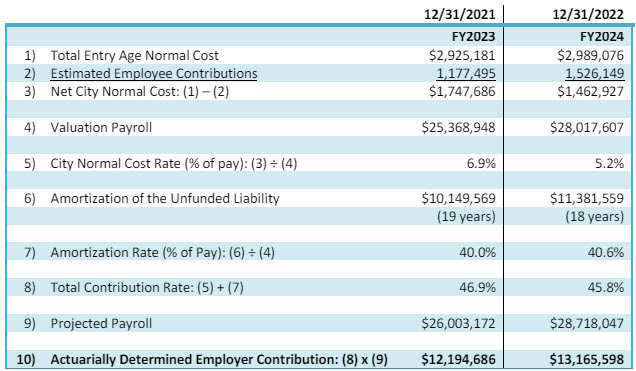

The calculation of the "Actuarial

Determined Employer Contribution" is pretty complicated for regular

folk. One part of it is the "Normal Cost," which is the amount that

must be set aside for the pension benefits earned in the current

year. The other is the "Amortization of Unfunded Accrued Liability,"

which is this year's payment on the funding shortfall accumulated

over the years. The amortization period is 30 years. In the example

below, which is from page 15 of the

2021 P&F valuation, a "City Normal Cost Rate" of

15.5% is

calculated along with an "Amortization Rate" of

41.0%. The sum of

those two rates - 56.5% - is then multiplied by the "Projected

Fiscal Payroll" to get the "Total City Contribution."

Here are the figures for Police & Fire

since valuation year 2009:

|

Police & Fire City

Contribution Calculation |

|

Valuation

Year |

Normal

Cost

Rate |

UAAL

Amortization

Rate |

Projected

Fiscal

Payroll |

Normal

Cost

Amount |

Amortization

Amount |

City

Contribution

for P&F |

|

2009 |

15.47% |

10.22% |

30,442,645 |

4,709,477 |

3,111,238 |

7,820,716 |

|

2010 |

15.15% |

15.88% |

29,780,315 |

4,511,718 |

4,729,114 |

9,240,832 |

|

2011 |

14.27% |

24.83% |

25,918,180 |

3,698,524 |

6,435,484 |

10,134,008 |

|

2012 |

15.7% |

25.90% |

26,983,418 |

4,236,397 |

6,988,705 |

11,225,102 |

|

2013 |

16.9% |

24.90% |

26,405,725 |

4,462,568 |

6,575,026 |

11,037,593 |

|

2014 |

15.5% |

24.70% |

27,078,405 |

4,197,153 |

6,688,366 |

10,885,519 |

|

2015 |

14.2% |

27.1% |

27,876,798 |

3,958,505 |

7,554,612 |

11,521,768 |

|

2016 |

14.2% |

30.0% |

28,461,908 |

3,925,393 |

8,289,043 |

12,562,547 |

|

2017 |

15.0% |

32.0% |

28,826,947 |

4,259,106 |

9,111,290 |

13,554,239 |

|

2018 |

14.9% |

36.5% |

30,046,061 |

4,416,859 |

10,831,128 |

15,457,647 |

|

2019 |

14.9% |

42.0% |

29,774,287 |

4,311,568 |

12,184,933 |

16,950,155 |

|

2020 |

17.1% |

43.0% |

30,376,917 |

5,066,802 |

12,751,378 |

18,263,635 |

|

2021 |

15.5% |

41.0% |

32,138,666 |

4,862,612 |

12,860,303 |

18,165,988 |

Here are the figures for ERS:

|

ERS City Contribution

Calculation |

|

Valuation

Year |

Normal

Cost

Rate |

UAAL

Amortization

Rate |

Projected

Fiscal

Payroll |

Normal

Cost

Amount |

Amortization

Amount |

City

Contribution

for

ERS |

|

2009 |

10.32% |

12.31% |

30,601,855 |

3,158,111 |

3,767,088 |

6,925,200 |

|

2010 |

10.01% |

11.98% |

31,547,766 |

3,157,931 |

3,779,422 |

6,937,354 |

|

2011 |

7.50% |

24.45% |

26,874,899 |

2,015,617 |

6,570,913 |

8,586,530 |

|

2012 |

7.10% |

32.60% |

23,592,272 |

1,675,051 |

7,691,081 |

9,366,132 |

|

2013 |

8.60% |

40.40% |

21,521,242 |

1,850,827 |

8,694,582 |

10,545,409 |

|

2014 |

7.90% |

36.20% |

23,085,894 |

1,823,786 |

8,357,094 |

10,180,879 |

|

2015 |

7.20% |

35.70% |

23,924,600 |

1,722,571 |

8,541,082 |

10,246,872 |

|

2016 |

7.5% |

37.6% |

22,593,044 |

1,645,797 |

8,249,336 |

10,185,060 |

|

2017 |

6.4% |

35.4% |

23,604,264 |

1,493,978 |

8,252,934 |

9,880,932 |

|

2018 |

6.8% |

37.1% |

24,372,735 |

1,619,910 |

8,789,239 |

10,698,401 |

|

2019 |

6.9% |

41.6% |

25,453,989 |

1,711,938 |

10,307,068 |

12,349,529 |

|

2020 |

7.5% |

39.6% |

27,006,263 |

1,998,654 |

10,438,162 |

12,737,487 |

|

2021 |

6.9% |

40.0% |

26,003,172 |

1,747,686 |

10,149,569 |

12,194,686 |

And here, finally, are the totals for

P&F and ERS combined, showing the two components of the city

contribution: the normal cost and the amortization of UAAL:

|

P&F

and ERS Combined |

|

Valuation Year/Fiscal Year |

Normal

Cost |

Amortization

of UAAL |

Total

City

Contribution |

|

2009/2011 |

7,867,589 |

6,878,327 |

14,745,915 |

|

2010/2012 |

7,669,649 |

8,508,536 |

16,178,185 |

|

2011/2013 |

5,714,142 |

13,006,397 |

18,720,539 |

|

2012/2014 |

5,911,448 |

14,679,786 |

20,591,234 |

|

2013/2015 |

6,313,394 |

15,269,607 |

21,583,002 |

|

2014/2016 |

6,020,938 |

15,045,460 |

21,066,398 |

|

2015/2017 |

5,681,076 |

16,095,694 |

21,768,640 |

|

2016/2018 |

5,571,190 |

16,538,379 |

22,747,607 |

|

2017/2019 |

5,753,084 |

17,364,224 |

23,435,171 |

|

2018/2020 |

6,036,769 |

19,620,367 |

26,156,048 |

|

2019/2021 |

6,023,506 |

22,492,001 |

29,299,684 |

|

2020/2022 |

7,065,456 |

23,189,540 |

31,001,122 |

|

2022/2023 |

6,610,298 |

23,009,872 |

30,360,674 |

Retiree health care

In addition to employee pensions, the

City has to pay for "other post employment benefits" (OPEB) -

primarily, retiree health care - and these costs are outside the

responsibility of the retirement boards. They are not addressed in

the same actuarial valuation reports mentioned above - the

ones that calculate actuarial pension liability and required

payments by the City. The latest retiree health care actuarial

valuation reports were

issued in November 2021 and based on information provided by the

City as of January 1, 2021.

These reports are more confusing to me

than the pension reports. For example, does it make sense that a

report issued in November 2021 is based on information provided as

of January 1, 2021? To add to the confusion, there are two sets of

figures, one for fully pre-funded and one for partial pre-funded

(see pages 5 and 6 of the

P&F report).

I'm going to flip a coin and use the fully pre-funded figures.

This is from page 5 of the

Police & Fire

report:

This is from page 5 of the

ERS

report:

The ADEC (actuarially determined

employer contribution) for P&F is $13,178,502 and for ERS it is

$7,100,834 for a total retiree health care contribution of

$20,279,336. Add that to the $30,360,674 combined total contribution

for pensions and we have $50,640,010.

UAAL for retiree health care is $149,721,904 for P&F

and $79,193,893 for ERS,

for a total of $228,915,797. Add that to the $305,273,046

unfunded pension liability and we have $534,188,843. With 49,539

households in Lansing, $534.2 million comes to $10,783 per

household. And my figures for UAAL are about $200 million less than

what the

Lansing State Journal reported

in March 2021:

| |

Pension and retiree health

care payments will eat up about 26%, or $60 million, of the

[$227 million] budget. The city is grappling with more than

$730 million in underfunded pension and retiree health care

costs with payments expected to come due over the next

several decades. |

Local Retirement System Status

Report

Public Act 202 of 2017 requires all local

units of government that have a retirement

pension system or retirement health care system to submit reports to

Treasury's Municipal Stability Board no later than six months after the

end of its fiscal year. Lansing's fiscal year ends June 30. To find the data for any local

entity, go to

this page

on Treasury's website and click on the desired year at the bottom. The

report downloads to your computer. It is an Excel file listing local

government units by county. At the bottom of the screen are three tabs:

Local Unit Summary, Pension System Summary and Health Care Summary. The

detail is in the second and third tabs. The data comes from the Forms

5572, Retirement System Annual Report submitted by local units. These

reports are supposed to be available on the local units' websites. The

following figures come from the report "as of" August 2023:

|

|

Assets |

Liabilities |

UAAL

|

% funded |

|

|

P&F Pensions |

289,411,315 |

502,879,789 |

213,468,474 |

57.6% |

|

|

P&F Healthcare |

41,918,165 |

202,871,379 |

160,953,214 |

20.7% |

|

|

ERS Pensions |

153,666,353 |

312,157,774 |

158,491,421 |

49.2% |

|

|

ERS Healthcare |

69,887,591 |

157,216,430 |

87,328,839 |

44.5% |

|

|

Total: |

554,883,424 |

1,175,125,372 |

620,241,948 |

|

|

Mayor Andy Schor's

December 20, 2022 Press Release

Mayor Andy Schor announced today

that the City of Lansing is realizing significant savings to

unfunded long-term legacy costs and has reduced expected

liability by nearly $400 million.

Schor prioritized the financial

stability of the City early in his first term and took several

initial steps to the address the issue. By working with the

City’s first Chief Strategy Officer, Shelbi Frayer, and

implementing reforms such as administrative rebidding, plan

administration changes, and prefunding OPEB by freeing up City

funds through other efficiencies and cost savings, the City was

able to realize these savings.

“Lansing’s long-term financial

health was an important priority for me when I first ran for

mayor. These costs represent retirees so we have to be cognizant

of that, but we also have to recognize the critical impact that

our long-term liability will have on future finances in the City

and services for Lansing residents,” Schor stated. “By working

together and making some smart, responsible changes, we have

been able to bring this unfunded liability down significantly.

There’s more to do, but this is an incredible step forward.”

For years, Lansing has struggled

with unfunded actuarial accrued liability (UAAL) obligations,

peaking at approximately $907 million in 2020. That total

includes the City’s pension costs as well as retiree healthcare

obligations, also known as other post-employment benefits (OPEB).

In 2012, the City formed a group

of outside experts known as the Financial Health Team (FHT) to

provide guidance and direction to the Mayor and City with

respect to various financial matters. Over the last decade,

countless hours have been spent by dozens of volunteer FHT

members to work toward the common goal of ensuring long-term

financial sustainability for the City.

Upon taking office in 2018, Mayor

Schor reviewed and acted on FHT recommendations. He worked with

the FHT and City Council create and fund the Chief Strategy

Officer, a new senior position in City government to focus

specifically on the City’s legacy debt and strengthening the

overall financial trajectory of the City.

| |

Year |

Assets |

Liabilities |

Unfunded Liabilities |

| |

2020 |

544,765,633 |

1,451,713,946 |

906,951,313 |

| |

2021 |

641,608,155 |

1,155,021,778 |

513,413,623 |

| |

Change |

96,842,522 |

(296,692,168) |

393,537,690 |

“We will always be a willing

partner to the city and through our continued collaboration we

have made substantial changes to the future viability of the

city all while maintaining benefits to past, present, and future

employees,” said UAW Local 2256 President Dennis Parker, who

serves as Chair of the Lansing Employees’ Retirement System

Board of Trustees.

“Working together in the spirit of

collaboration between my administration, City Council, and our

incredible labor force, these goals certainly can be achieved as

we continue to focus on securing the long-term stability of the

City’s finances,” Schor concluded.

|