|

City gives State Journal incorrect

pension amounts

December 21, 2017

When I read the Lansing State Journal's August 10 story,

"Overtime spikes pensions for dozens of Lansing police, fire retirees,"

I suspected that the pension amounts provided by the City of Lansing

were not the full amounts. Pensions are calculated as service times

final average compensation (FAC) times a multiplier - in this case,

3.2%. For example, if a firefighter has 25 years of service (the minimum

required) and his average pay for the last 2 years was $80,000, his

pension would be $64,000 (25 x 80,000 x .032). This amount is called the

"full retirement allowance," and is not necessarily the same as the

pension. The pension payment amount may be less depending on the survivor

option chosen by the retiree. One option allows the surviving spouse to

receive 75% of the pension, and to pay for it, the pension received by

the retiree is reduced to 93% of the full allowance. Another allows the

surviving spouse to receive 86% of the pension and the pension received

by the retiree is reduced to 86%. The full text of that part of the city

ordinance is

here.

I doubted that the pension amounts

provided the LSJ were the full amounts. The City charged only $338 for

160 retirees. While pension payment amounts were

readily available, the full amounts were less so, and the City would

have charged more to get them.

In the

LSJ story, reporter Beth LeBlanc said

Thirteen Lansing police officers and

firefighters who retired between 2010 and 2016 make more in pension

than the base wage they received in their final year employed by the

city.

Another 57 of the nearly 160 police

and fire retirees during those years receive a pension of between

90% and 100% of what their base pay was in their final year.

If the City had given her the full

retirement allowances rather than pension payment amounts, those figures

would have been higher.

I set about getting the full retirement

allowances. I sent a Freedom of Information Act request asking for the

same information provided to the LSJ, but with straight life pension

amounts. By "straight life" I meant full retirement allowance, not

realizing at that time that the term used in the ordinance was full

retirement allowance. The City

wanted well over $1000, so I

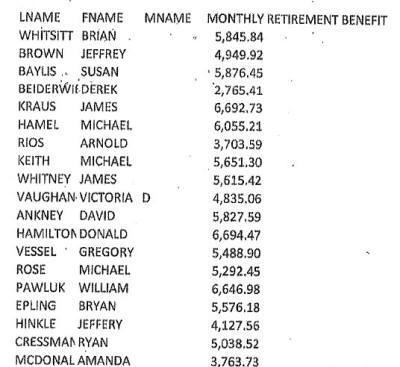

withdrew that request and asked for the same information provided to the LSJ. They sent me that document for free. It is a

168 page PDF document. The first 4 pages are a list

of retirees and amounts. Here's a portion of

the first page:

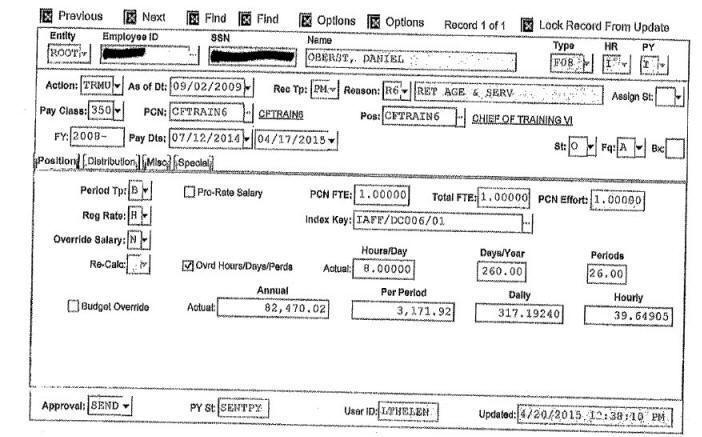

Each of the remaining 164 pages contained

a document that showed - among other information - the employee's base

pay amount. Here's an example:

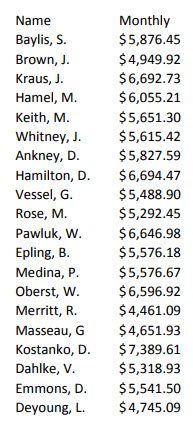

Still determined to get the full

retirement allowance, I sent a new request, this time for the

straight life pension amounts for 20 employees who retired in 2015 and

2016. The City responded

with a

one-page list. I was not charged.

Up until then, I hadn't actually read the

section in the ordinance about survivor options, and when I did, I

realized that the term "straight life pension" is not used. I sent a new FOIA request:

I have to apologize. In my previous

FOIA requests, I asked for the "straight life" pension amounts for

certain Police & Fire retirees. I now realize that this term is not

used in the Police & Fire Retirement System. It does not appear in

the ordinance. The term for what I want is "full retirement

allowance." I would like the full retirement allowance for [the 20

Police & Fire Retirement System retirees].

This time, there was a

charge: $125.88. There was no charge for the straight life pension

amounts I'd received earlier. Did that mean that the straight life

pension and the full retirement allowance were different?

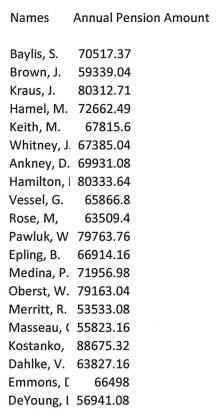

I paid the $125.88. On December 1, I got another

one-page

list:

The next day, I sent another another

request:

I realize that in my original FOIA

request I did not specify that I wanted the source documents that

showed the full retirement allowance for the 20 retirees listed in

that request. However, the source documents are what I need, and the

$125.88 I paid should get me more than the single-page list of

retirees and amounts identified only as "monthly" that was provided

. . . As an example of what I mean, I have attached a "Retirement

System Computation Sheet" for a 2011 retiree. That particular

form may no longer be used, but I would expect that something

similar is used that details the computation of the pension.

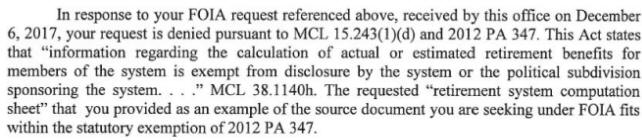

My request was

denied:

Public Act 347 of 2012 is the bill I've been

complaining about since December 2012, when Governor Snyder signed it

into law:

I appealed the denial to the city council president Patricia Spitzley on

December 11:

Dear Councilwoman Spitzley,

I would like to appeal the denial of a

FOIA request.

On October 17, I requested the "full

retirement allowance" for a list of 20 police and firefighters who

retired in 2015 and 2016. The full retirement allowance is the

calculated pension before any reductions for survivor options. It

has also been known as the straight life pension.

On December 1, after receiving my

payment of $125.88, the Office of City Attorney sent me a one-page

document (attached) listing the 20 retirees along with amounts

identified only as "Monthly." Since the "full retirement allowance"

is normally an annual amount rather than a monthly amount and since

no supporting documents were provided, I suspected that the amounts

provided were monthly pension payment amounts rather than the full

retirement allowance.

| |

On December 2, I submitted a new

request asking for the source documents for the retirement

allowances and I attached a "Retirement System Computation Sheet"

for a 2011 retiree ("Halverson," attached) as an example of what I

wanted.

On December 11, my request was denied

("Denial Letter," attached) because "information regarding the

calculation of actual or estimated retirement benefits . . . are

exempt from disclosure.

I accept that this is the law.

However, the information regarding the calculation of the benefit

could be redacted. That would consist of the final average

compensation (FAC), which is of no interest to me. My only interest

is the "full retirement allowance" or "straight life amount." I

already have retirement date, retirement age and service amount, all

of which are provided in Retirement Board meeting minutes.

Please ask the Retirement Office/City

Attorney to provide the 20 computation sheets with the FAC redacted.

|

|

|

Patricia Spitzley |

The City has had no

problem with redacting documents

in the past.

I received

her response December 20. She upheld the denial of my request.

Problems with the LSJ story

If the pension amounts the City gave the

LSJ were payment amounts rather than full retirement allowances, the

story understated the number of pensions that exceeded 90% of base pay.

And I do have evidence that the LSJ did not get full retirement

allowances.

Back before April 2013, when the law

prohibiting release of pension details went into effect, I got pension

calculation sheets for dozens of City retirees, including 42 of the

police and firefighters whose pensions and base pay was obtained by the

LSJ. Those calculation sheets included the full retirement allowance.

This chart compares the pension and base pay amounts provided by the

City to the full retirement allowance. For 29 of the 42 - 69% - the full

retirement allowance is more than 90% of the base pay. In the LSJ story,

70 of 160 of pensions exceeded 90% of base pay. That is only 44%.

Not using the full retirement allowance

was one error. The other was giving the wrong multiplier - twice. Here's

the first:

For most Lansing police and fire

retirees, pensions are equal to

2.5% of the final

average compensation multiplied by a maximum of 25 years of

employment. The formula changes slightly depending on which contract

a police or firefighter retires under.

Here's the second:

The multiplier for both departments

for non-supervisor roles has decreased to

2.5%.

The ordinance says that a police officer

hired before August 1, 2014 and a firefighter hired before May 20, 2014

shall have a 3.2% multiplier. Those hired after those dates get a 2.5%

multiplier. So anybody who retires before 2039 is going to have a 3.2%

multiplier. Nowhere in the LSJ article is the 3.2% multiplier mentioned.

Everybody makes mistakes, but when a news

organization makes a mistake, it is expected to issue a correction. It

is expected to value accuracy. On August 11, I sent Beth

LeBlanc an email that said:

Beth, great story about

Lansing police and firefighter pensions. But I think that except for

new hires, the pension multiplier is 3.2% rather than 2.5%.

She replied:

From what I could glean from the

police and fire contracts, the 2.5% -- depending on which contract

youíre looking at Ė largely applies to those hired after 2014. We

included a line in the story saying the changes depend on when an

employee was hired or retired to acknowledge that difference.

I

emailed her again on September 17:

It appears that about half

the Police & Fire pension amounts you were given by the City are

incorrect. Through a FOIA request, I got the same information you

got.

It appears that we were

given the monthly pension payment amount. If the retiree chose the

straight life retirement option, the payment amount reflects the

actual pension. However, if a beneficiary option is chosen, the

payment amount is reduced in order to offset payments to the

beneficiary after the retiree's death, so the payment amount does

not reflect the full value of the pension. The straight life amount

is FAC times .032 times service, and service is always 25 unless the

retiree is age 55 or older or has reciprocal service from another

employer.

I suspected early on that

you were given payment amounts rather than the straight life

pension, and that is why my first FOIA asked for the same info you

got, but with straight life pension amounts. For that, they wanted

to charge me $1710.85. So I settled for the same info you got,

realizing that for several 2010, 2011 and 2012 retirees, I had the

straight life pension amounts, which I got from the actual pension

calculation sheets. The attached document lists 43 of them. For only

about half of them does the straight life amount equal the amount

calculated from the amounts provided by the City. Where the straight

life amount exceeds the calculated amount - 13 out of 43 - I assume

the retiree chose a beneficiary option. Where the calculated amount

exceeds the straight life amount, I have no idea what's going on.

What this means is that

there may be a lot more cases in which pension exceeds base pay than

you thought. It is troubling that no one at the City cautioned you

about using monthly payment amounts. . .

I

got no response. On September 27, I forwarded the above email to LSJ

publisher Rebecca Poynter and executive editor Stephanie Angel with this

note:

| |

I am forwarding you an email

I sent Beth LeBlanc on September 17 pointing out some problems with

her August 10 story, "Overtime

spikes pensions for dozens of Lansing police, fire retirees."

She has not responded.

While that story had a lot

of good information, approximately half the pension amounts she got

from the City of Lansing were incorrect and over a quarter of them

were too low. As a result, your readers were mislead. It is likely

that the pensions of a lot more than 13 exceeded base salary. In

addition, she said the pension multiplier is 2.5%. That is true for

new employees, but for any retiring in the next 20 or so years, the

multiplier is 3.2%.

|

|

| |

Rebecca Poynter |

|

The City of Lansing's

pension costs are crippling the city and the people deserve nothing

less than the whole truth. I think it would be best for you to issue

a correction rather than have me point out the errors on my website.

I am a long time LSJ reader and would rather support the media than

criticize. I would be happy to meet and discuss this. |

They did not respond.

Defending the high pensions

In

addition to the misleading information in the LSJ article, some of the

people quoted made questionable statements:

-

Eric Weber, president of

International Association of Firefighters 421, said "Not many people

hire broken, busted up police and firemen. Quite frankly, our pension is

all we have. . . After retirement, it's the only income we have."

I

think he exaggerates. These people are retiring in their late 40s and

early 50s. I suspect they are in better physical condition than people

their age with less strenuous jobs. Anyway, disabled doesn't mean

unemployable. Teresa Eisfelder, one of the retirees interviewed for the

article,

retired with a duty

disability and now works for the U.S. Marshalls in Georgia.

I suspect that most

Police & Fire retirees have new

jobs lined up before they retire. Many of them spend large sums to

purchase service credit so they can get out in less than 25 years. Here

are some whose new jobs were in the news:

|

Eric Weber |

-

Mark Alley, Lansing's former chief of police, retired in March

of 2010 to take a job as senior director of risk management for

Emergent BioSolutions Inc. in Lansing. His title now is Vice

President of Global Protective Services and Public Affairs.

We don't know his new salary, but we do know that his

pension from the City is $90,356. Alley retired at

age 48. He had only 24 years and one month of service, so he

purchased another 11 months at a cost of $107,812.

-

Police Lieutenant

Bruce Ferguson retired in 2010 at age 50 with a

$66,507 pension.

In January 2013, he became chief of police for the City

of DeWitt at a salary of $65,000. (Lansing State

Journal, 1/26/2013)

-

David Ford and Walter

Holden retired from the Fire Department in June 2010 to

run First Due Fire

Supply in Mason - established April 2007. Ford's pension is

$70,356 and

Holden's is

$62,288.

Employees also include Lansing firefighter Chris Wheeler and

duty disability retiree Dan Hamel (retired 7/20/2010, pension

$45,560).

Ford and Holden later sold the company to Hamel and are

"working on some other ventures."

-

State Rep. Tom Cochran, D-Mason,

retired as Lansing's fire chief in January, 2012 at age 58.

He receives a pension of approximately $77,000 from the City

to supplement his $71,685 salary as a state representative.

-

Lansing police captain Ray Hall

retired in February 2012 at age 49 to take a job with University of

Michigan-Flint as chief of police. According to

this

response

to my FOIA request, his new salary is $103,000. His City of Lansing

pension

is $73,178. He was 16 months shy of the 25

years needed to qualify for a pension, so he purchased

16 months.

-

In July 2013, former Lansing police chief Teresa Szymanski landed a job as

the Lansing School District's chief operations officer. She

retired from the Lansing

police force on April 19, 2013 at age 50, with 26 years of

service. Her salary on her new job is

$120,000. Her annual pension from

Lansing's Police and Fire Retirement System is about

$90,000, based on what her predecessor

Mark Alley got when he

retired in March 2010.

-

In February 2014, Lieutenant Noel

Garcia retired from the Lansing Police Department after 24

years (LSJ, 2/28/2014). He immediately took a job as law

enforcement instructor for the Lansing Area School District

at a

salary of $62,631. His pension is

approximately $60,000.

-

In November

2014, at age 45, assistant fire chief Trent Atkins accepted the new

position of Emergency Operations Manager at the Board of

Water and Light. His salary was $130,000. He was 9

months short of the 25 years needed to qualify for a City of

Lansing pension, so he purchased them. His pension will

be "around $70,000." (LSJ, 11/25/14)

He resigned from the BWL just recently,

saying "he has offers to do consulting work and wants to

spend more time with his family." (LSJ, 5/20/17)

-

Daniel Oberst

was chief of training for the Fire Department when retired

on April 18, 2015. His pension is about $79,000. He is now fire chief

for Bath Township, where his salary is

$61,675.

-

Detective Teresa

Eisfelder retired 3/20/2012 at age 46 with a duty disability. She now works for the U.S.

Marshalls in Georgia as a federal court security officer. Her

pension is $64,936 (LSJ,

8/10/17).

What's often overlooked, [IAFF

president Eric] Weber said, is the fact that police and fire

retirees in Michigan do not receive Social Security. As a result,

pensions for public safety employees are often higher than others.

Not getting Social Security at age 66 or

67 does not justify a generous pension

at 50. Currently, the full benefit age is 66 for people born in

1943-1954. It will gradually rise to 67 for those born in 1960 or later.

And Weber fails to mention that while Lansing police and firefighters

don't get Social Security, neither do they pay in to Social Security.

And by the way, Eaton County sheriff

employees do participate in social security. And still get a 3.2%

pension multiplier.

-

In

reference to an abandoned state-level proposal to

exclude overtime from final average compensation, Thomas Krug, head of

the union that represents Lansing police officers, is quoted as saying

"I do not think itís fair to cut overtime out when [overtime is

mandatory]". It is not that officers will not get paid time-and-a-half

for overtime; they just wouldn't get paid twice by using it to boost

their pensions. And whether it was intentional or not, the contract

requirement assigning overtime to those with most seniority ensures

that police in their last 2 years get that extra income included in

their FAC.

Send comments, questions,

and tips to

stevenrharry@gmail.com, or call or text

me at 517-505-2696. If

you'd like to be notified by email when I post a new story, let me

know.

Previous stories

|

|

|

Tom Krug |

|